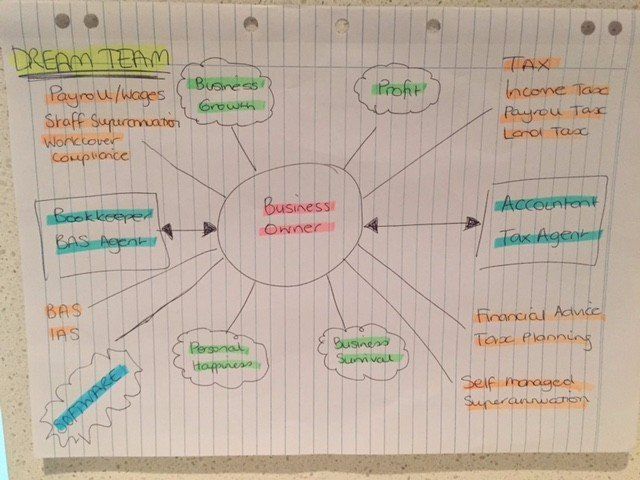

Business Owners - Accountants - Bookkeepers - its a 3 way partnership for success.

Why GREAT bookkeeping might just be your secret weapon in business.

As a business owner you have to ‘do the books’.

It is an unavoidable part of your business life - whether you like it or loathe it, to comply with the law - be it GST or income tax law - you need to bookkeep.

You didn’t necessarily set out to be in business to keep the books - yet you must.

The Law says so.

So do you

1. Do it yourself

2. Engage an accountant to do the bookkeeping

3. Engage a bookkeeper to do the bookkeeping

OR do you indeed need all 3??

This is where it gets interesting for you.

I am a bookkeeper - that means I keep the books for many different businesses.

I have built a business from keeping the books for businesses just like yours.

Here is what I see out there in the field…..

Some business owners will choose to do their own books

Some business owners will engage their accountant to do their books

Some business owners will seek out a bookkeeper - perhaps when the going gets tough even perhaps from a referral from

their accountant.

Other business owners will ignore compliance and hope that it goes away.

Let’s presume that because you have read to here - that you are not a number 4.

So what do you do?

Door number 1 - Do it yourself.

No shame in this. I actively encourage all business owners I deal with to know and understand their books.

Just like you doing a simple oil change on your car yourself, with the correct instructions, you can do your own books.

My advice to you if you choose this option is

1. Get a great piece of software that does the heavy lifting for you and has checks and balances to ensure you don’t get it

wrong.

2. Get trained in the software - you will pick up shortcuts and tips and tricks along the way

3. Invest in setting it up software and business paperwork and systems so they are customized for you, your business and are tight processes that ensure correct flow of information.

Don’t forget to get a ‘health check’ periodically too - this ensures you stay on track! Laws change, software is updated and generally you ‘don’t know what you don’t know’!

Golden Rule - although you can ask friends and/or google the basics - just like that oil change, you wouldn’t undertake a full engine rebuild without consulting an expert.

Door number 2 - Engage an accountant to do the bookkeeping.

I love accountants - they are generally a smart, savvy group of professionals adept at assisting you navigate the financial aspects of your business.

Just remember - not all Accounting practices do bookkeeping. Do not presume that when you engage an accountant that they will also be doing the bookkeeping.

Accountants give great advice on tax matters, organization structure and other financial aspects of your business. They are all different and you need to find the correct fit for you and your business.

They can do so much more than lodge your Tax Return. Sadly most clients I meet do not harness the resource they already have in their accountant.

A good accountant will assist you to comply, a great accountant will go on your business journey with you and offer extensive resources to assist you.

Here’s my tips for a GREAT relationship with your accountant

1. Agree on the scope of work - what are you engaging them to do?

2. Charge rate - annual, monthly, quarterly - what does it include?

3. How does their bookkeeping service differ from their accounting service?

4. Will the work be completed in-house - will you get to meet the bookkeepers?

5. If the accountant doesn’t offer bookkeeping - can they provide a referral ?

But don’t take my word for it - I sat down for a coffee with Mark Lawry of Suntax - a progressive Accounting Firm and asked his thoughts on what a ‘perfect match’ between accountant, client and bookkeeper could look like & why when you get it right it could be the ‘secret sauce’ for a successful business.

Here were his thoughts….

“It is no accident that business success is directly linked with the financial understanding that the business owners have about their business. This is where bookkeepers are essential in business, not only do they keep your bookkeeping up to date, but because of their regular interaction, they are able to highlight areas of concern generally before the it is on the business owners radar. These areas of concern generally include cash flow shortages, accounts receivable that are getting 'out of control' and general profitability of the business. From my point of view, bookkeepers not only help businesses survive, they help businesses thrive."

“

Mark Lawry

Partner

Suntax

For me, I only partner with GREAT accountants

Door number 3 - Engage a bookkeeper

My pet peeve with this option is when business owners automatically assume when they start a business - that they need to engage a bookkeeper to sit onsite in their office for a set number of hours and automagically their compliance is taken care of. Maybe…..

The cold hard reality is that bookkeeping is a regulated profession these days. Depending on whether the bookkeeper is employed by you or contracted - and also considering the tasks they undertake- they may be required to be a BAS Agent.

Just as we have Tax Agents - we have BAS Agents who are suitably qualified to provide BAS services. It has been recognized that you need specific skills to undertake most aspects of traditional bookkeeping - including payroll.

I could write page upon page on engaging a bookkeeper but for the sake of brevity here are my key take aways when engaging a bookkeeper

1. Don’t just ask about experience - ask about qualifications

2. Get references or read client testimonials

3. Look your potential bookkeeper up on Google, Facebook, Professional Associations Member Directories like ICB, and software websites who also have partner directories - stalk them!

4. Consider their fit with your business e.g. size of practice, the bookkeeper’s business ‘personality’.

5. Set clear expectations of what you will do as a client, what you want the bookkeeper to do and where the accountant fits in

So if bookkeeping is more than simply compliance - where is the secret weapon?

A good set of books will:

Ensure you comply with relevant legislation and further avoid penalties for non-compliance.

Keep your accountant happy at tax time so they can get on with on time lodgment

Let you sleep easy at night knowing you comply

A great set of books will:

Enable you to analyze your figures - and further enable planning for increased growth or profit.

Allow you to extend the conversation with your accountant beyond compliance and into tax planning and tax effective strategies.

Enable you to bed down the basics and reach your end goals - be they increased profit, sale of your business or future proofing the financial survival of your business.